Marketers today have more control over their advertising investment than ever before. By control, I mean marketers have many options for how to spend their ad dollars, very little commitment in terms of minimum spend levels, and rich data to pour through to measure results. Marketers can reallocate their ad budget weekly, daily, even hourly for certain channels. Despite this flexibility, however, many marketers still use antiquated methods to optimize their ad budgets. Here are six tips to help you systematically boost your marketing performance.

Optimize Through Simulations

The ultimate goal of any marketer is to grow revenue predictably and efficiently. One critical step is knowing the optimal media mix that produces the maximum result for any given ad budget, subject to any constraints. Attribution models and media mix models only report on past marketing efforts. Neither process alone tells you the optimal way to allocate your budget. There are two common methods for optimizing your ad budget: linear programming like Excel’s solver add-in, and simulation-based optimization.

The problem with linear programming is that it breaks down with non-linear constraints.

Linear programming is widely used across many industries as a way to optimize an objective function (e.g. sales or revenue) subject to constraints (budget, capacity, available inventory, etc.). The problem with linear programming is that it breaks down with non-linear constraints. Most marketing productivity functions are non-linear. For example, let’s say that sales resulting from TV spend can be explained by a non-linear S-curve comprised of increasing returns to scale followed by decreasing returns to scale. This non-linear equation produces multiple basins of attraction in linear programming. If the solution gets caught in one of these basins that represents a local optimal solution and not the global optimal solution, solver will still converge on the local solution. The ‘solution’ that’s not actually optimal.. Hmm. I’ve personally had experience with this and it’s quite frustrating.

One work-around is to reset solver by running multiple iterations, randomizing the inputs between each iteration. You can setup a VB macro to do this in Excel. The downside is you can never be confident that you ever actually achieve the optimal solution. The hope is that enough iterations will make Solver eventually find the global optimal. Good luck finding the global optimal solution though if you have a media mix model comprised of dozens of non-linear formulas.

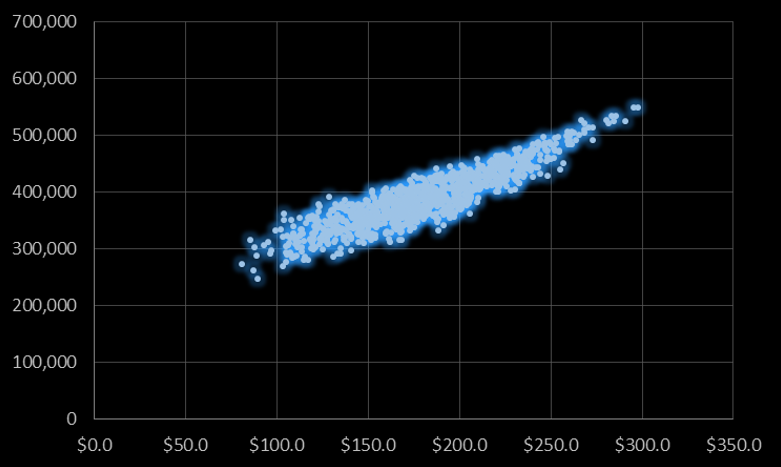

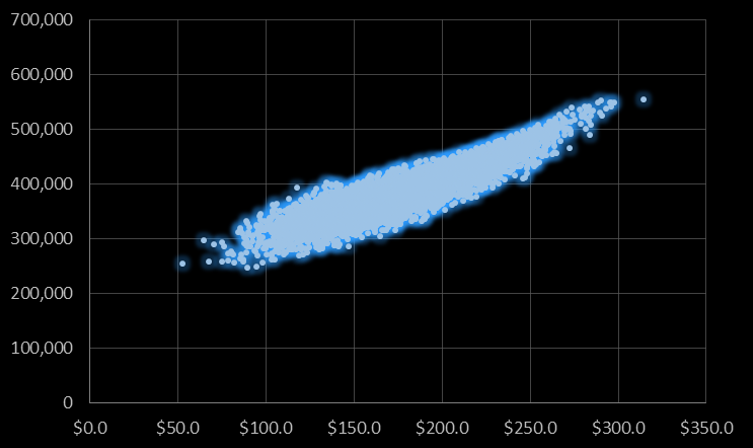

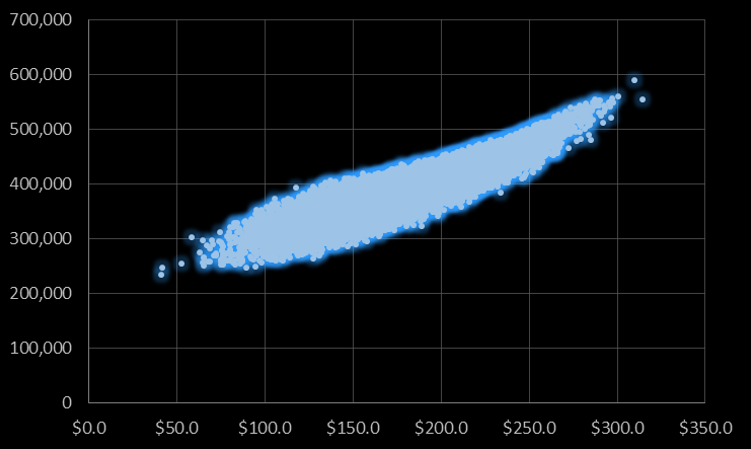

A better approach is to run simulations using media mix regressions. Program an econometric model with all of your media mix functions (a regression-based forecast), and run simulations based on random inputs. Any cross-channel interactions (such as TV spend driving up paid search sales) are captured in your media mix functions. Setup your simulation to randomly select inputs for all marketing channels within reasonable minimum and maximum constraints. Then setup a macro to run the simulations. You may see something like the charts below. The x-axis represents annual ad spend (in millions), and the y-axis represents sales.

After 1,000 simulations:

After 5,000 simulations:

After 18,000 simulations:

As you increase the simulation count, the resolution of the leading edge improves. Just as an investment manager optimizes portfolio returns by maximizing the Sharpe ratio (maximizing the return for a given level of risk), you’re also developing an efficient frontier of outcomes, maximizing sales (or revenue) at various ad spend levels.

I typically run several hundred thousand scenarios and then extract the top 1% of outcomes at evenly defined budget intervals (e.g. every $1mm in annual spend for bigger marketers), and then average the media inputs across the top 1% of outcomes. Now you have optimal inputs for various budget levels that can be loaded back into your econometric forecast. Then determine the budget level that produces a marginal cost equal to your marginal revenue (discussed in Tip #4), and this is your aggregate profit maximizing budget. If productivity or costs change, adjust your inputs and re-simulate.

Recent Comments