Merchant Processor Wins with B2B Direct Mail Retargeting

A national provider of small business merchant processing services wanted to expand customers of their subscription card processing services. Their service provides a mobile point of sale system that can flexibly process credit and debit transactions for small businesses and provide other useful services such as menus, seating and sections, inventory management, and so on. This mobile merchant processor is perfect for any small business, but setting up B2B marketing can be challenging.

Why Direct Mail Retargeting is a Good Fit

Retargeting through digital can be difficult because the market is already so saturated and worn out. Placement for your display ads is limited by competition you face from other businesses. Also (it goes without saying but I’ll say it anyway), remember that your ads can only show up if that recent visitor spends time using the platforms you’re using for retargeting. Our goal was to increase sales of this subscription service through direct mail retargeting; an option that is guaranteed to serve an impression and be more scalable long-term if you have an effective strategy in place. This particular site sees hundreds of thousands of visitors, however not all of those visitors are here to purchase. The challenge would be identifying “in-market” small businesses. Here’s how we helped this company figure out how to get B2B leads from their existing website traffic using direct mail retargeting.

How We Made Direct Mail Retargeting Work for B2B Marketers

We setup a direct mail campaign with a weekly cadence to recent website visitors (we could have sent daily campaigns but the client’s print processor required weekly) in an effort to drive them back to the site to complete their purchase. We were most interested in the people who went to the “sign up” page and then abandoned the process. But other engagement was useful too such as whether they viewed product pages, FAQs, etc. We matched this audience to a U.S. national consumer file and then to a U.S. national business file. This sophisticated process of weeding out low-engagement visitors vs those visitors expressing greater interest and matching known businesses was a key component of the process

Identifying Qualified B2B Leads

Not all website visitors to this merchant processor were qualified small businesses, in fact some visitors could not be identified as consumers at all. For example, we found that visitors who had no match to a national U.S. consumer file had the lowest purchase rates (indicating potential identity resolution challenges). Conversely, those visitors that matched a national B2B registry had the highest purchase rates. Keep in mind that this marketer was targeting very small businesses (think about Jobs and Wozniak building the Apple-1 operating out of a garage), which may not even be on a B2B list yet. Nonetheless, qualifying leads is an important task for any B2B marketing. Constructing experiments and segmenting audiences like this is exactly why we construct tests, and it allows us to further optimize programs over time.

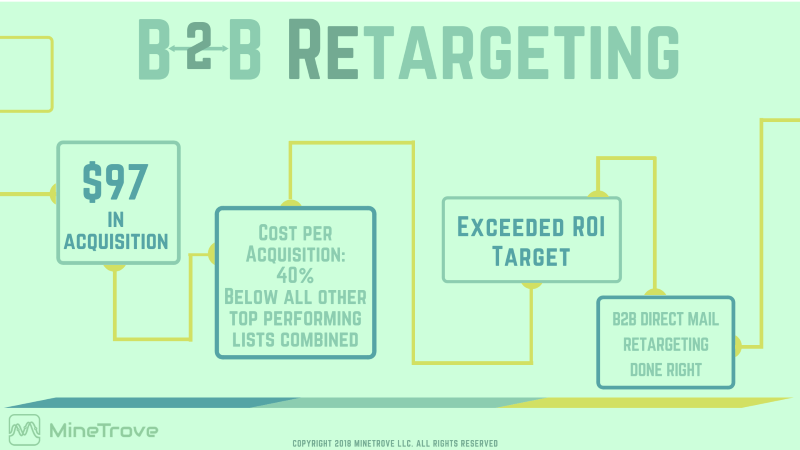

Overall the test resulted in a $97 per customer acquisition, which is 40% below the average cost of their top-performing marketing lists. We were also able to exceed their ROI target right out of the gate, even though that typically only happens after months of testing. Direct mail can benefit businesses not only in retail, where it is more common, but also in financial services. Contact us to find out how to grow your business.